Morning Star Pattern in Forex

The morning star forex candlestick pattern is one of the reverse candlesticks. Reversal candlesticks, as we know, are trading patterns that indicate a potential swing in future trends.

Any area of the trading industry, including stocks, forex, indices, ETFs and commodities, can exhibit morning star patterns. It is a component of the technical analysis of reversal candlestick patterns.

Read further to understand the meaning behind the morning star forex, how to identify the forex morning star pattern, and what it indicates.

Morning Star Forex Meaning

Key Takeaways

- The morning star forex patterns are developed over three periods;

- Morning star patterns are bullish reversal patterns;

- Candlestick charts are used to identify morning star in forex trading patterns;

A bullish candlestick pattern known as the morning star forms when there is a downward trend. At the end of a downward trend, three candles are known to form.

The morning star pattern on a market’s chart is a set of three candlesticks predicting an impending bullish reversal. A morning star that appears after a downturn is interpreted by technical traders as a sign that buyers may be gaining ground on sellers.

Typically, the first of the three candles has the longest body. The next candle is smaller, and the last one is shaped like a star. This star indicates that the downward trend is showing signs of weakness.

The morning star becomes significant when the fourth candle opens over the star candle’s body. It becomes more significant if the fourth, fifth, and sixth candlesticks are bullish. In most cases, that indicates more buyers in the market.

A morning star candlestick pattern is reasonably easy to recognize. You must first be familiar with the candle’s appearance. It features two little shadows and a small body. Most of the candlesticks will be red if you select the default setting on your trading platform.

In light of this, let’s examine the strategy for correctly identifying the morning star candlestick step by step.

Start by examining the chart’s general trend.

A morning star can only form when the trend is bearish.

Look closely for a long bearish candlestick pattern.

Typically, you want to see at least three consecutively bearish candles.

A small red candlestick with a small body and tiny shadows is what you should search for.

A small morning star is followed by a big bullish green candlestick.

Now, the market ought to have reversed and started a new uptrend.

When assessing an indicator, such as the forex morning star pattern, it is important to consider the current trend and if there is enough evidence supporting the trade.

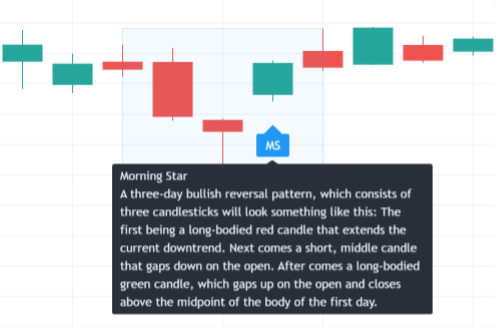

The Morning Star Candlestick

A candlestick chart is popular amongst technical analysts when identifying a morning star forex pattern. The candlestick chart is used to predict or anticipate price action of a derivative, currency, or security over a short period. The pattern formed is known as the morning star pattern forex.

The morning star is merely a visual representation; no calculations are required. There are other additional ways where you can see the star forming. After three sessions, you’ll either see it is performing, or it doesn’t occur at all. Examples include the price action that acts as support or the relative strength indicator (RSI) that reveals excessive stock sales.

What Does a Morning Star Tell You?

A morning star develops in a downward trend and marks the beginning of an upward rise. It indicates a reversal in the earlier price trend. Traders look for the emergence of a morning star before using further indications to verify the occurrence of a reversal.

There are no specific calculations because a morning star is simply a visual pattern. A morning star is a three-candle pattern in which the second candle contains the low point. The low point, however, is not visible until the third candle has closed.

Forex Morning Star Pattern

The common consensus is that morning star patterns are a fair indication of market movement. They are also a helpful early candlestick pattern for technical traders just starting out because they are relatively easy to recognize.

When trading morning stars, there are a few things to be aware of:

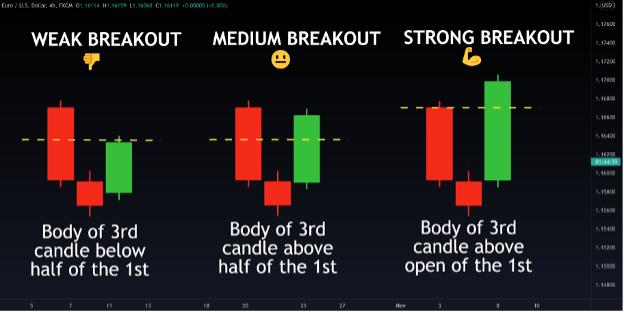

- The market has recovered a minimum of 50% of its losses from the first session if the last candle closes more than halfway up the body of the first.

- The middle candlestick’s body width provides a helpful indication of the signal’s intensity; the shorter, the better.

The middle session usually takes the shape of a spinning top. A Doji morning star, however, is a variant of this pattern in which the middle stick is a Doji. This signal is thought to be the strongest of them all.

Morning and Evening Star

An integral component of a technical trader’s toolkit is the morning star and evening star patterns. Morning and evening star forex patterns are very similar to each other.

A three-candlestick pattern called the morning star can indicate a market reversal. The pattern consists of a long bearish candle, a short bullish candle that gaps down from the first candle, and then a long bullish candle that closes above the first candle’s midpoint.

In contrast, the evening star pattern is a long bullish candle that follows a short-lived bearish candle that gaps up from the first candle, then a long bearish candle that closes below the midpoint of the first candle.

The morning star forex pattern is thought to be more bullish than the evening star pattern, even though both patterns are thought to be reversal patterns.

Morning Star – Pros and Cons

| Forex Morning Star Pros | Forex Morning Star Cons |

| Regularly occurs in the forex market. | Price could decrease further if the reversal fails. |

| The pattern has clearly marked entry and stop levels. | Morning stars are traded based only on visual patterns, which might be risky. Therefore, the best morning stars are supported by volume and other indicators, such as a support level. |

| Forex morning star patterns can be easy to identify. | The morning star pattern is relatively uncommon in times of a bull run. This occurs because reversals during this period are typically limited, especially on daily and weekly charts. |

| The morning star pattern forex might/may be/ often is relatively accurate, although no pattern is 100% accurate. | |

| The candlestick pattern is suitable for many assets, including currencies and stocks. | |

| Other reversal indicators, such as double exponential moving averages, can use the morning star forex pattern. |

A Morning Star Trading Strategy

The morning star candlestick forex trading strategy is used by technical traders and can be traded in the following way:

1. Identify the pattern

A candlestick chart with a long bearish candle, a short-lived bullish candle that gaps down from the first candle, and then a long bullish candle is what you want to find. Make sure the pattern is forming at the end of a downtrend or at the end of a consolidation period before trading it.

2. Look for convergence

Once you’ve identified a morning star pattern, keep an eye out for more indicators that the market is truly reversing. Moving averages, Fibonacci retracement levels, and support and resistance levels are a few instances of confluence elements.

3. Select an entry point

When trading the morning star pattern, there are possibly two ways to enter a trade. The first method is to wait for the pattern’s third candle to close before establishing a long position on the following candlestick. The second method is to set a stop-loss order below the low of the third candle in the pattern.

4. Select an exit point

There are in practice two ways to close a position. The first method is to hold onto the position until the price reaches a support or resistance level before closing it. The second method involves placing a take-profit order with a risk-to-reward ratio of 1:1.

5. Establish your risk management parameters

It’s essential to practice sound risk management while trading any kind of reversal pattern. That entails placing a stop loss and generating profits when certain levels are reached.

Conclusion

Morning star patterns are ideal when you need to identify the formation of a bullish reversal pattern. To be successful, traders should first practice with a demo account and conduct research to minimize risk.

Additionally, traders should consider using forex morning star patterns with other patterns to get their full benefits.

Frequently Asked Questions

A bullish reversal pattern called a morning star pattern occurs at the bottom of a downtrend. It shows that buyers have taken control of the price in an upswing, while sellers have lost momentum. It is a U-shaped combination of several candlesticks that shows a change in the trend’s direction.

A price upswing’s peak, where evening star patterns first appear, is bearish and indicates that the uptrend is about to end. The morning star forex pattern, seen as a bullish reversal candlestick pattern, is the opposite of the evening star pattern.

A bullish reversal is signaled by the morning star candlestick, a triple candlestick pattern. It forms at the bottom of a downtrend and indicates that the downtrend is about to reverse.

Morning star forex patterns are reliable technical indicators for a bullish reversal after a long downward trend. Even though the morning star pattern is quite effective, traders should practice with a demo account and conduct thorough research to reduce risk.