Shanghai lockdown unnerves the market

Oil => The commodity falls below $110

Xpeng => The stock trades down 25% this month

EUR/GBP => The pair looks to 0.8300

Oil drops as Shanghai locks down

Oil prices are falling 3% at the start of the week as volatility shows no signs of easing.

Oil prices are falling on fears of falling demand as China’s Shanghai starts a two-stage lockdown amid surging COVID cases. The drop in oil comes after prices rose over 8% across last week owing to supply concerns from the ongoing Russian war and, despite the US and allies considering another big release of oil reserves to ease supply fears.

Separately, data on Friday showed that the number of US rigs rose for the 19th month but at the slowest pace since 2020, despite the government calling for producers to increase output.

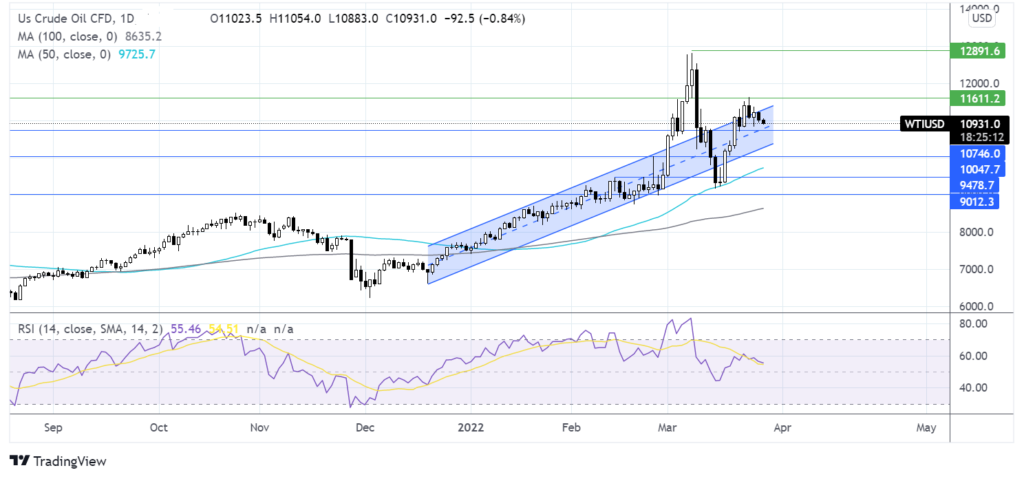

Where next for WTI crude oil?

Oil rose to 116.33 last week before running into resistance and falling lower.

The price has fallen back into the rising channel dating back to mid-December. The RSI remains in bullish territory but heads towards 50. Sellers will look for a move below 107.20, the March 22 low in order to look towards the lower band of the rising channel at 102.75.

A fall below 100 could see the sellers gain traction.

On the flip side, buyers could look for a move over 113.00, the upper band of the rising channel, to bring 116.33 back into play.

Xpeng Q4 earning preview

XPeng will release Q4 earnings before the US opening bell today.

The Chinese EV maker saw deliveries rise an eye-watering 263% across last year to 98,000;

This is expected to double to 192,771 deliveries in 2022, despite supply chain issues and rising costs.

Expectations are for revenue to jump to RMB 8,049.5 million in the final quarter of last year, up from RMB 2,851.4 million the year before. Net loss is expected to be RMB 2.08 per ADS after widening from RMB 0.53 loss posted in the previous year.

Investors will be keen to hear any developments regarding its European expansion.

EUR/GBP rises, BoE’s Bailey to speak

After booking losses across the previous week, EUR/GBP is edging higher today.

After inflation, the pound posted gains rose to a 30 year high of 6.2% despite consumer confidence plunging and retail sales unexpectedly falling. The euro remained out of favor amid the fallout from the ongoing Russian war.

Overall, confidence in the euro is fragile. On Friday, the IFO business climate index fell by the most on record in March. Today the pair is rising, but gains could be capped amid underlying concerns over the impact of very high energy prices.

There is no high impacting euro or UK data. Instead, a speech by BoE’ Andrew Bailey could be in focus and the latest Ukraine crisis talks.

| Ger. IFO business confidence

UK Retail sales Feb. MoM |

Actual: 90.8 (7.7)

Actual: -0.3% (2.1%) |

Previous: 98.5

Previous: 1.9% |

Support can be found at 0.8296 (last week’s low) and 0.8275 (3 March low).

Resistance for the pair can be seen at 0.8365 (50 sma) and 0.8410 (100 sna)

Sign up to tixee for Daily Financial Market News & Updates!