Forex Trading – EUR/USD Strategies to Use Now

How to Trade the EUR/USD Pair & what are the Forex Trading EUR/USD strategies?

Forex Trading – EUR USD strategies are an important asset in your trading portfolio.

As the most prominent liquid currency pair in Forex, the EUR/USD has tight spreads and wide price movements that provide a large flow of profitable opportunities to any forex trader.

It is no wonder why it is the most traded currency pair in the foreign exchange market.

However, trading the EUR/USD pair requires skill.

To achieve maximum profitability, traders need to learn the ins and outs of the trade. More specifically, they need to learn how to analyze the Euro Dollar Trends and how to use that analysis to trade the pair.

This article provides information that all traders need to know about trading the EUR/USD pair, including:

- What the EUR/USD price change and ‘pip’ mean in forex trading

- What has affected the history of EUR/USD

- How to analyze Euro Dollar Trends

- Strategies to trade the EUR/USD pair

- How to buy EUR/USD on MetaTrader

- Which trading account is best

What is the EUR/USD Price Change and the ‘pip’ meaning in Forex Trading

As we know, currency pairs in forex markets quote one currency (base currency) against another (counter currency).

For the EUR/USD pair, the EUR is quoted against the USD currency. The resulting price of the quotation then becomes the value of the pair.

For example, if the EUR/USD is determined as 1.12, it means that a trader will need 1.12 USD to buy 1 Euro. This also means that 1 Euro is equal to 1.12 USD, and that, consequently, the value of the Euro is greater than the value of the Dollar by 0.12.

Because the value of each currency is determined by their respective central banks and the economy of their respective nations, the exchange rate, or the value of the EUR/USD pair keeps changing. This change in the value of the pair is what is referred to as the EUR/USD Price Change.

But what does this Price Change mean when it comes to forex trading?

It is simple. The price change determines what currency in the pair is stronger than the other. In the above example, where the value EUR/USD was 1.12, we determined that Euro is stronger than the Dollar by 0.12.

If this price were to go up by 0.13 so that the value of the EUR/USD becomes 1.25, this means that the Euro is increasing in strength as compared to the Dollar. But if the price were to go down by the same value of 0.13, it would mean that the Dollar is increasing in strength while the Euro is weakening.

What a ‘pip’ Value Means?

A ‘pip’ value, which is an abbreviation for Percentage in Point measures the smallest change in currency pairs.

Because the value of most pairs is usually represented by four decimal points, the ‘pip’ value affects the fourth decimal point.

For example, if the EUR/USD was 1.2345 and it experiences a one-pip rise, the value of the pair will be 1.2346, which means the value of the Euro will have increased as compared to the Dollar.

In forex trading, the ‘pip’ value, no matter how small, makes a huge difference to traders as it can lead to either major loss or profit.

What has Affected the History of EUR/USD

Just like any other FX pair, the history of EUR USD is majorly affected by two factors – the economy and the monetary policy of the respective economic zones.

The Monetary Policies, which are tied to the economic events of the respective nations, are determined by the Federal Open Market Committee (FOMC) for the US. For the European Union it is the European Central Bank (ECB).

However, the underlying economy and the central bank policy are not the only factors that have affected the US and European Exchange Rates over the years.

Here are other factors that have also contributed to the rise and fall of the EUR/USD in the financial markets:

- Political events

- Price Stability

- Financial Crisis

- Level of Unemployment in the economic zones

- Interest Rates

- Market Volatility

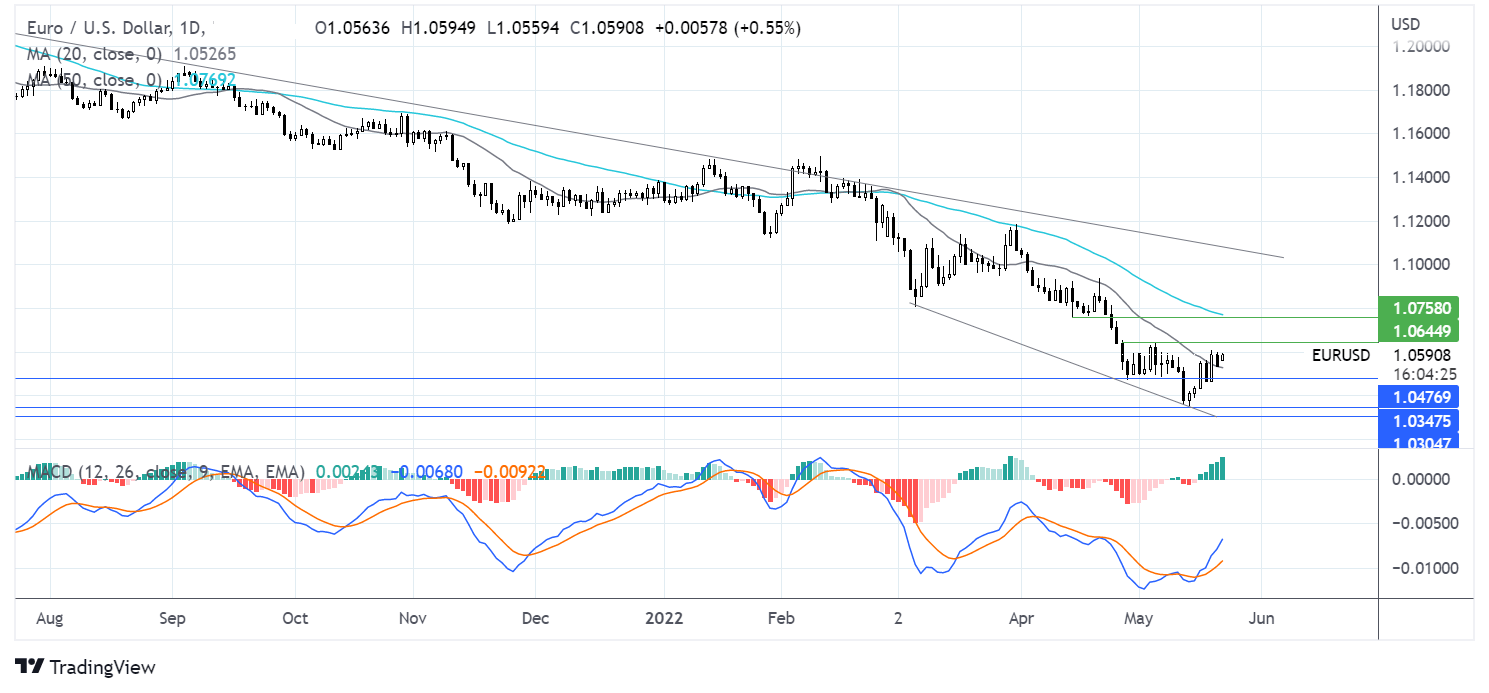

How to Analyze and Trade Euro/Dollar Trends

As one of the major currency pairs, the EUR/USD has large trading volumes that can be overwhelming to an unprepared trader. Before trading with the pair, it is advisable that the traders first learn how to analyze the trends associated with the Euro Dollar.

Some of the EUR/USD trends traders should be familiar with include:

- The Underlying Trend

The underlying trend, also referred to as the historical exchange rate, is the trend that has existed over a long period of time. To analyze the underlying trend of the EUR/USD, a trader should mostly focus on how the trend of the dollar moves on the daily charts. - The current trend

The EUR/USD current trend refers to the current market activity. It is analyzed by checking if the trend is consistent with the underlying trend on either daily charts, an hourly chart or an hourly volatility chart. Once analyzed, the current trend will determine if a trader will invest in EUR/USD or not. - The Price Action

Classic price action refers to a plot of how the price of a commodity, asset or stock moves with time. It is analyzed by determining how the price moves using price action rules, price drivers and price action patterns.

Once plotted, the interactive charts can be used as technical indicators that enable the traders to know when the best time to invest in EUR/USD is.

Forex trading EUR-USD strategies

Using fundamental analysis or USD technical analysis to predict how the price moves, traders can discover a wide range of forex trading EUR/USD strategies they can use to trade the EUR/USD pair.

However, there are only three strategies that are known to bring in the results:

- Breakdown/Breakout trading strategy: In this strategy, the trader buys the breakout and sells the breakdown. The payoff happens when the resistance levels break, paving the way to profit potential from low-risk trade entries.

- Pullback strategy: in this strategy, the trader can either decide to buy the pullback or sell it. The strategy denotes levels of resistance, described either as high, low or key levels. These levels, which are interpreted using Fibonacci retracements, moving averages and inception points, are then used to restore the initial trend direction by ending the price swing.

- The Range Pattern Strategy. This strategy is applicable when price has been consolidating within a range, being locked between support and resistance. The trader can buy at the lower bound of the range and sell at the higher bound of the range.

Forex Styles for EUR/USD Trading Strategies

Here are the three main trading styles for EUR/USD according to trading schedules:

- Scalping : the trader’s trading schedule lasts for a short time period, usually minutes.

- Intraday trading: the trading session lasts several hours within the day. Also referred to as day trading, intraday time frames should end when the intraday traders or day traders successfully make a trade.

- Swing trading : unlike in day trading, the trader targets a particular weekly or monthly trend and sets their trading session when there is a trend.

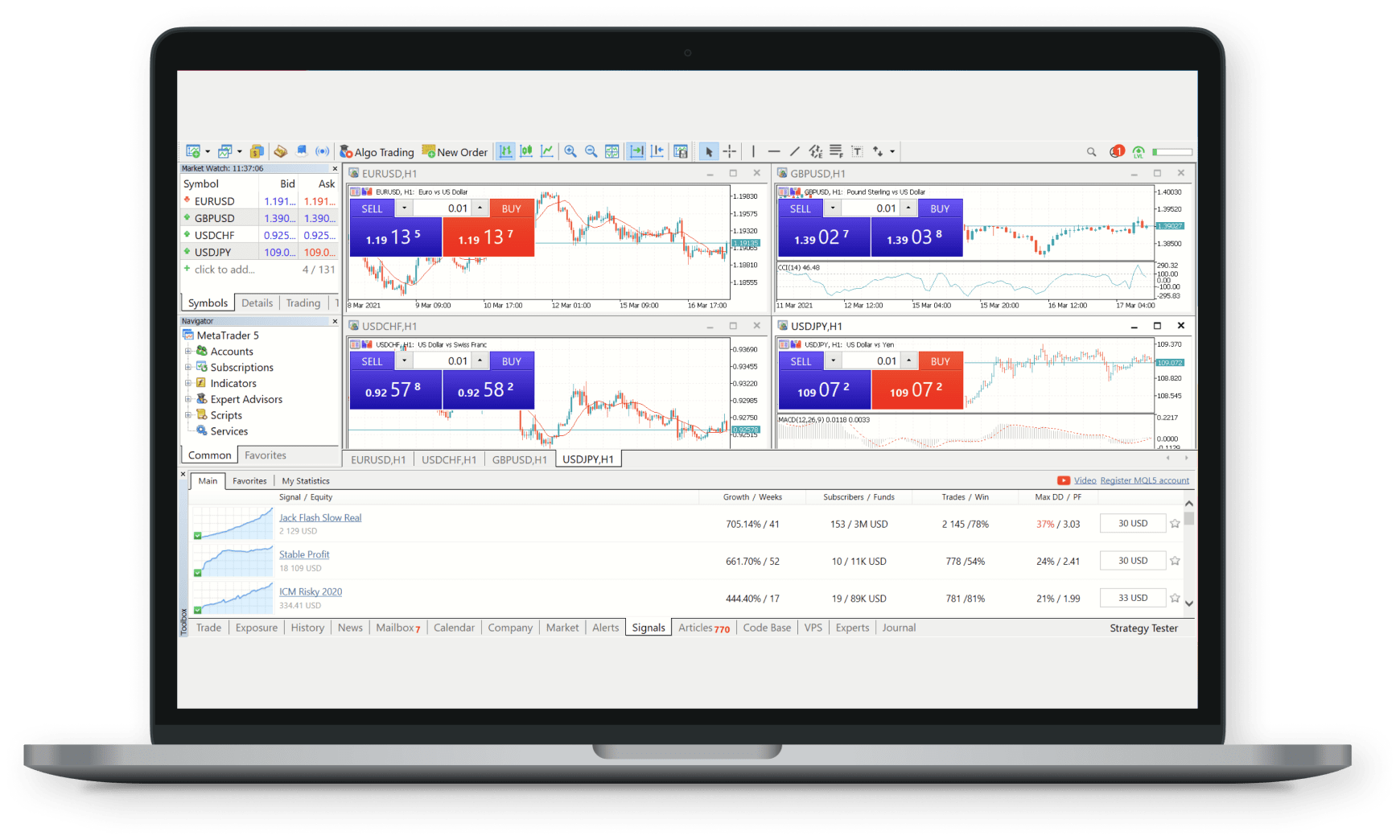

How to Apply Trading EUR/USD Strategies on MetaTrader 5

As one of the popular Forex trading platforms, MetaTrader 5 is the most preferred when buying or selling EUR/USD.

Here are steps on how to buy EUR/USD using the MetaTrader platform:

- Download the latest version of the MetaTrader 5 Application on your computer and install it, then run it.

- Locate the “New Order” icon on the tool and click it.

- On the “Symbol” field, select the “EURUSD” option

- On the “Volume” field, select the size of your position

- Click “Buy in the market.”

What Trading Account is Best?

A trading account or a brokerage company is a company that gives traders access to the market and guides them on how to make wise investing decisions.

There are dozens of trading accounts in the forex labor market and ultimately, a trader should choose one that is suitable for them.

tixee is a trading account that in our opinion, is the best in the market and helps you to understand how to trade EUR/USD forex at a professional. Here are four reasons why traders should create an account with tixee and start trading:

- tixee Web Trader is compatible with all devices to ensure its traders have a smooth trading experience and that they never miss any economic news.

- It gives the traders access to the largest trading blocks in the market, including stocks, indices, commodities and every single currency, whether it is a digital or physical currency.

- Offers support to its traders providing analytics related to such topics as central bank decisions etc.

- Suitable for traders of all levels of experience.

Conclusion

Learning how to trade EUR/USD forex is essential for any trader who wants to join forex.

As the official currency of the nations that have the largest economies and the largest reserve currency in the world, EUR(base currency) and USD(counter currency)have many trading opportunities and strong liquidity, unlike other currencies like the Canadian Dollar, or the Japanese Yen.

The pair is also accessible to everyone at any time of day, making it suitable for a day trade, night trade, or trend trade.

Frequently Asked Questions

- What are Currency Correlations?

Refers to two pairs that make progress in similar directions. - How much do you need to trade EUR/USD?

You can trade the pair with any amount of money you have, as long as you can be able to buy or sell the pair. - How much do traders in forex make in a day?

According to a forex day trader, traders can make on average $3,750 or 3,080 European Currency Units a month. - What are the best hours to trade forex?

The ideal time to trade in forex depends on the trader and their preferred time to day and hour to trade. For every trader, the trading day is determined by the trader.