Cautious hope of Ukraine crisis progress lifts risk sentiment.

Dow Jones => The index rises above 33100

AUD/USD => The pair falls below 0.7250

Oil => The commodity falls towards $104

Dow Jones rises after a weekly loss

The Dow Jones fell 2% across last week, marking its 5th straight week of losses.

The US index lost 3.5% in February and is already down 2.75% so far in March. The index lost ground after the latest Russia-Ukraine peace talks failed to break the stalemate and as inflation hit a fresh 40 year high at 7.9%.

With oil prices up 14% so far in March, higher inflation is expected going forwards, coupled with lower economic growth. Today the index is pointing higher as Russia and Ukraine hail progress in peace talks despite the bombings continuing.

There is no high impacting US data due to be released. The market will start positioning for the Federal Reserve interest rate decision on Wednesday when the Fed is expected to begin its rate hiking cycle.

Where next for Dow Jones?

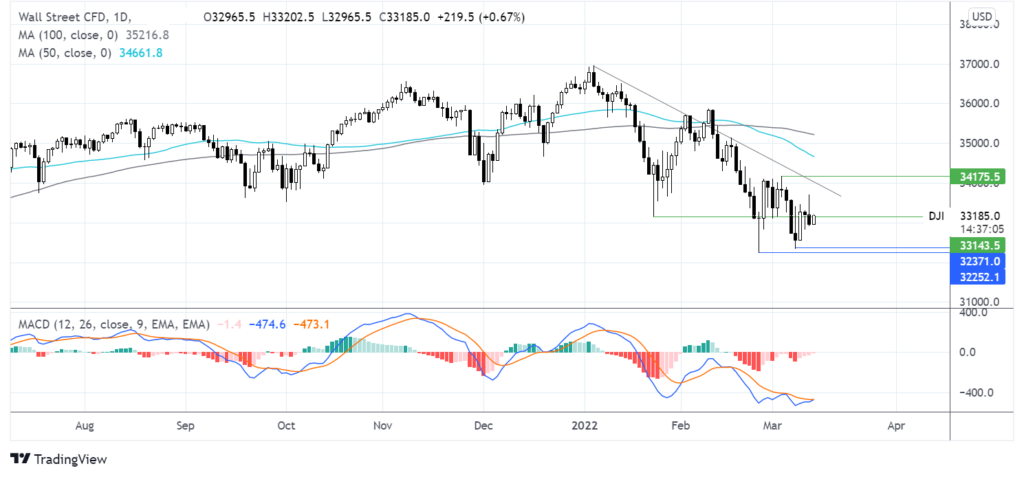

The Dow Jones continues to trade below its falling trendline dating back to early January and below the 50 & 100 sma.

The 50sm crossed below the 100 SMA in a bearish signal. 32250 continues to offer strong support, which has held since last March.

A break below here would open the door to 30000, the psychological level.

On the upside, the buyers are finding optimism from the bullish crossover on the MACD. However, a close over 33100 the January low is needed to confirm a move towards 34000 round number and falling trendline support.

A move above 34175 is needed for buyers to gain momentum.

Aussie underperforms peers

After falling 0.9% last week, the Aussie is extending losses at the start of the week.

The risk sensitive aussie is shrugging off the improving market mood and instead follows commodity prices lower. Gold, an important Australian export, trades 0.7% lower as risk aversion eases cautiously.

The minutes of the RBA monetary policy meeting could influence the pair. The minutes come from the meeting where the RBA decided to keep monetary policy unchanged, despite inflation expectations rising firmly.

The minutes could provide clues over the timing of the first post-pandemic hike, expected later this year.

Chinese retail sales could also influence the pair. Meanwhile, the Fed is widely expected to hike rates on Wednesday.

Oil falls on peace talk optimism.

Oil prices fell 5% last week, including a 12% selloff on Wednesday alone, following a rally of 26% the week before.

Volatility in oil prices has surged after Russia invaded Ukraine and after the US banned Russian oil imports. Investors are trying to identify where a supply plug could come from.

Talks with Venezuela are taking place, the UAE has said they could be interested in hiking oil output, but OPEC+, which counts Russia as a member., is unlikely to add more supply.

Today oil prices are heading lower on hopes that there could still be a diplomatic solution to the Ukraine crisis, ahead of more peace talks this week.

Support can be found at 102.50 (last week’s low) and 100 (psychological number)

Resistance can be seen at 108.50 (Friday’s high) and 115.80 (3 March high).